powerball cash option calculator|powerball tax calculator by state : iloilo Use this tool to compute the payout, tax and odds of winning Powerball jackpot. See how much you would get after taxes if you choose the lump sum or annuity optio. WEBparadise_city__ recordings from Chaturbate. Explore the biggest Chaturbate archive - .

0 · powerball tax calculator by state

1 · powerball payout rules and tax

2 · powerball calculator puerto rico

3 · powerball annuity vs cash calculator

4 · powerball annuity payout chart

5 · powerball annuity cash calculator

6 · lottery tax calculator by state

7 · lottery calculator payout by state

webBásico: você pagará um preço baixo pela maquininha e terá as taxas gerais do Mercado Pago para vender com débito, crédito e parcelado. SuperVista Promocional: você terá taxas baixas para vender no crédito à vista e débito. Durante 30 dias ou até vender R$ 5 mil. Após receber a maquininha.

powerball cash option calculator*******Here’s how much taxes you will owe if you win the current Powerball jackpot. You can find out tax payments for both annuity and cash lump sum options. To use the .

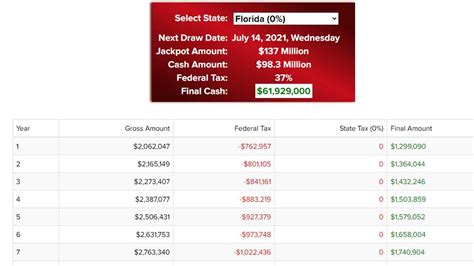

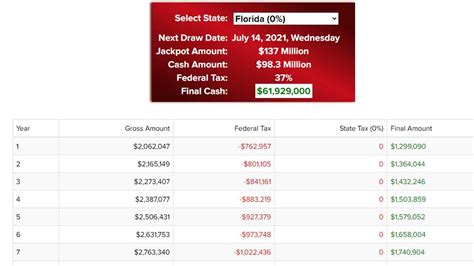

Estimate how much money you will receive and compare the Powerball lump sum vs. annuity payouts with this tool. See the gross, federal, and state taxes .Use this tool to compute the payout, tax and odds of winning Powerball jackpot. See how much you would get after taxes if you choose the lump sum or annuity optio. Compare the net payouts of Powerball jackpot options after federal and .Calculate how much tax you have to pay and compare the lump sum and annuity options for Powerball jackpot. Enter the jackpot amount, select your state and see the payout chart and final amount after tax.Calculate Powerball taxes in your state to see how much the lottery is worth after taxes with a lump sum payment or the annuity option. Calculate your net payout after taxes for Powerball lump sum or annuity options. Enter your jackpot amount, country and state to see how much you will get after federal, state and local taxes.Learn how much tax you might have to pay on your Powerball winnings depending on the prize amount, the jurisdiction, and the payout option. Use the tax calculator to see your . Compare the annuity and cash lump sum options for the current Powerball jackpot and see how much tax you would pay in different states. Use the annuity .

Calculate how much you win with Powerball after taxes and cash option. Choose your payment method, state, prize amount and see the results for lump-sum and annuity options. You can get a quick estimate for the Mega Millions cash value calculator by deducting 37% of the amount advertised as the Mega Millions payout today. For example: The advertised amount is $1,000,000. Assume that at . The total tax you pay on $1 million would be $240K (24%) for the federal tax and $50K (5%) for the state tax in Arizona. That makes the total net payout $710K. It’s worth noting you’ll also pay taxes over the .

You can easily calculate the federal and state tax liabilities, both for annuity and lump sum payments, using our calculators above! Easily calculate taxes on lottery winnings by each state plus the payouts for both cash & annuity options using our lottery calculators. You can also calculate your odds of winning Mega Millions and Powerball!powerball tax calculator by state The estimated cash jackpot when the advertised jackpot is $20,000,000. $9,619,048. Withholding (24%) Federal tax. Select your tax filing status. -$2,308,571. Arizona (4.8%) State tax. The estimated amount of state tax you will pay on a cash jackpot win of $9,619,048.

Total Payout (after Taxes): Example Payments. Initial (1st) Payment (after Taxes): 10th Payment (after Taxes): 20th Payment (after Taxes): Final (30th) Payment (after Taxes): If winning the lottery is still just a dream, then you’ll know that the odds of your ticket winning certainly aren’t great. But buying lottery tickets online as part . Powerball® Estimated Jackpot Calculation Documents. Drawing Estimation History. Powerball game began Monday draws on 08/23/2021. First drawing in which Powerball's starting jackpot and minimum roll increases are determined by Multi State Lottery Powerball Product Group's Chair and Vice Chair was 04/11/2020. CVO = . If you win the minimum $20 million jackpot and choose the lump sum payout, the Federal government withholds 24% from your winnings automatically. If you are looking at a $12 million payout — roughly the lump sum option for a $20 million jackpot — you’ll pay $2,880,000 in taxes before you see a penny. Now you are down to $9,120,000 in . Annuity Payment Schedule. Here's how the current Powerball jackpot will be paid if the annuity option is selected. Current Powerball jackpot. Wednesday, Jun 26, 2024. $95,000,000. Withholding (24%) Federal tax. Select your filing status. -$22,800,000.

If you are uncertain, our Powerball payout and tax calculator can generate the results for both and let you have a clearer vision of what you can do. State – Your state or the state where you will play Powerball impacts your final payout because state taxes can vary from 0% to almost 10%. Prize – The total prize that you will win.Powerball lump sum: How it works. Just like it sounds, the lump-sum option pays out the cash value of the jackpot all at once. In the case of the $112 million Powerball pot, the cash value is $75.4 million. Unlike the annuity that is taxed as you receive your annual payments, the winner who takes the lump sum pays all applicable taxes upfront.Play Powerball Now. *Cash Lump Sum: $45.7 Million. The choice of payment type is completely up to you, the winner. The most noticeable difference between the values of the Powerball lump sum vs the annuity is that the cash option is always lower. The advertised jackpot is always stated as the full annuity amount. Since lottery annuities typically follow a growing annuity structure, where the amount of yearly payout grows by a given rate, the lottery annuity may take the following form: P n = -PV / [ (1 - (1 + g) t) / g] * (1 + g) n - 1. where: Pn - Payout in the n-th year; PV - The gross amount of lottery prize, which is the present value (PV) of the .The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule, which increases the amount of the annuity payment every year. The table below shows the payout schedule for a jackpot of $84,000,000 for a ticket purchased in California, including taxes withheld. Please note, the amounts shown are very close .powerball cash option calculatorFor Michigan this is an additional 4.25%. - $25,925. Net Payout. $437,675. Note: The ‘Net Payout’ is how much you would receive from the lottery win. You would then need to include this amount on your personal income tax return and pay further income tax. The tax bracket would vary depending on your other income.

The Non-Cash payouts are no longer equal payments, and are now annuitized, starting lower and increasing each year by about 4-5% depending on the lottery you are playing. See INSTRUCTIONS below. Changed Lump Sum payouts on 8/25/2021 base on Est Cash Value based on each of the original sites. REMEMBER: enter '1200' for 1.2 billion.

For our calculations we’re using an average reduction amount of 39%. - $390,000. Federal Taxes (24%) Read Explanation. Before you even receive any of your lottery winnings the IRS will take 24% in taxes. - $146,400. Ohio Taxes (4%) Read Explanation. Each state has local additional taxes.

Federal taxes on lottery winnings are significant, with higher prizes facing a federal tax rate of 37%. The federal tax rate of 37%, the top federal tax rate, applies to the portion of your winnings that exceeds $1 million, including lottery winnings from mega millions or Powerball. Additionally, state income taxes may also apply, depending on . The advertised cash value of the lottery changes with each drawing. Recently, the jackpot stood at an estimated $1.326 billion . (That's an estimated payout of $621.0 million.

A XP Investimentos CCTVM S.A., inscrita no CNPJ/ME sob .

powerball cash option calculator|powerball tax calculator by state